A Look at Trading Behaviour During the Coronavirus Crisis

The measures taken by countries to tackle Coronavirus have triggered an economic downturn across the world. There is still no insight into when this crisis will end and how far will it disrupt lives. The economic turmoil associated with the pandemic has had severe impacts on the financial markets, including equities, commodities (crude oil and gold), forex and the bond markets. Major events, like the Saudi-Russia oil price war, triggered a stock market crash in March 2020, followed by a global crude oil crisis.

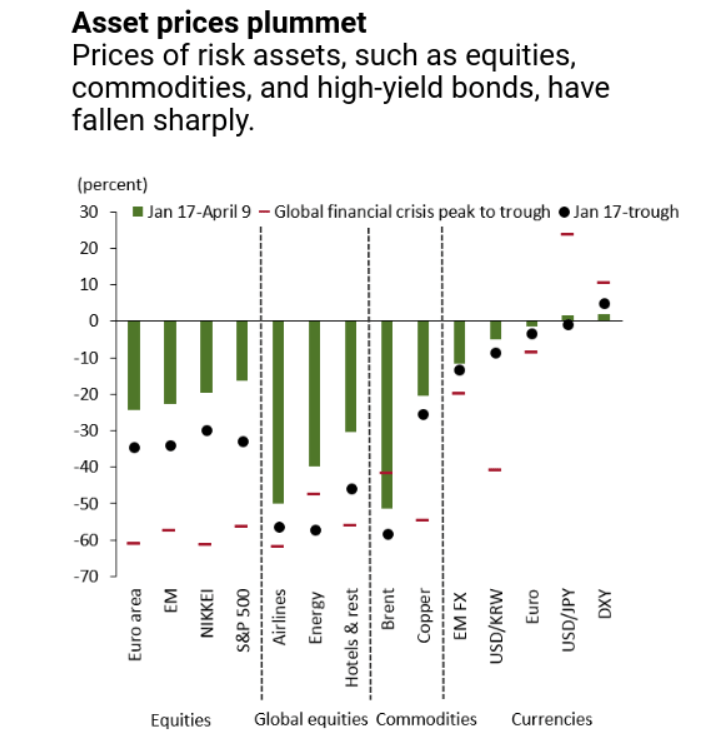

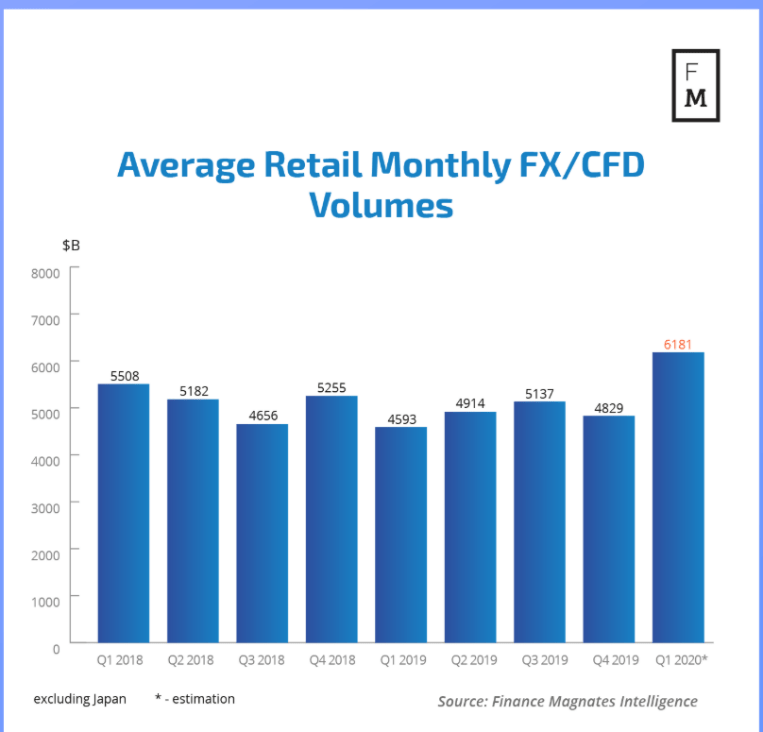

Since the outbreak of the pandemic, risk assets have suffered declines more than the 2008-2009 crisis. In large and small economies, equity markets have declined 30% or more. There has been a jump seen in credit spreads, and the short-term funding markets, including the global market for US Dollars has been impacted as well. The April 2020 IMF Global Financial Stability Report says that any further intensifying of this crisis could lead to an unprecedented global financial instability.

Image Source: https://blogs.imf.org/2020/04/14/covid-19-crisis-poses-threat-to-financial-stability/

Financial market participants have reacted to these developments in different ways. In this period of extreme market volatility and fear of investment losses, reactions have been somewhat different than expected.

Extreme Volatility Means More Trading Opportunities

The uncertainty of the Coronavirus outbreak has triggered extreme levels of volatility in the global financial markets. In the US, volatility levels have surpassed those seen last in October 1987 and December 2008.

Image Source: https://insight.kellogg.northwestern.edu/article/what-explains-the-unprecedented-stock-market-reaction-to-covid-19

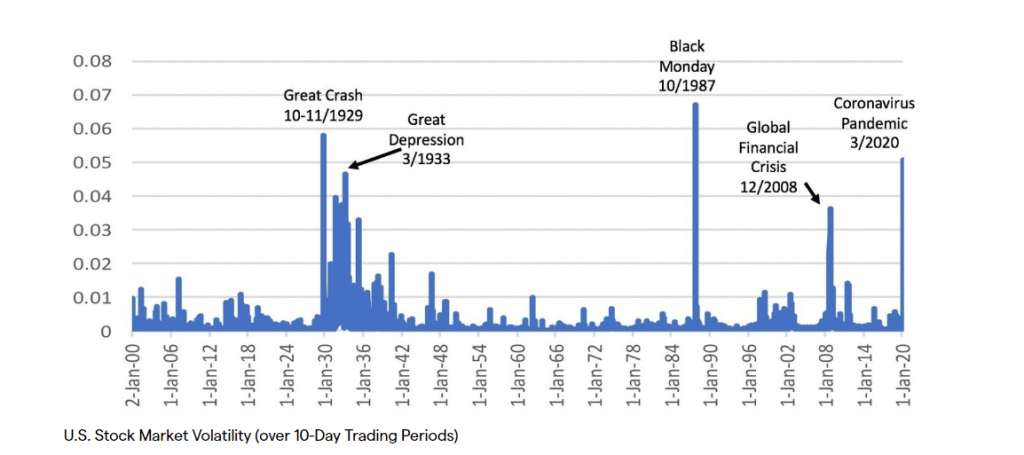

Volatility is also back in FX trading, which has led to a surge in trading volumes in recent times. The surge in volatility from February 2020 onwards has thrown up numerous trading opportunities for short-term traders. Traders are taking advantage of significant price swings in major financial markets including FX, indices and commodities. According to a report by Finance Magnates Intelligence, there has been a considerable boost to FX and CFD trading volumes in the Q1 2020, amounting to $6,181 billion.

Image Source: https://www.financemagnates.com/analysis-retail-fx/coronavirus-and-forex-how-well-are-brokers-faring/

To curb the expected financial downturn, central banks across the world have significantly eased their monetary policies by cutting down on rates. In many advanced economies, interest rates are at historic lows. With interest rate deductions and uncertainty in the real estate sector, the stock market has also seen an increase in investments, despite the market shocks.

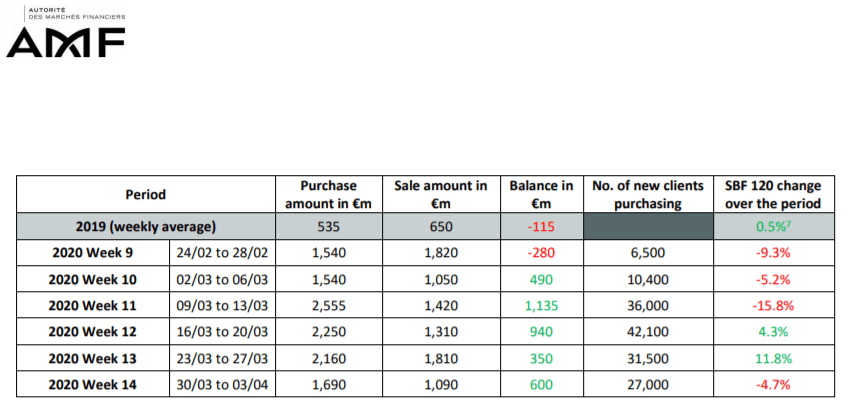

In a report on retail investor behaviour in the equity markets during the Coronavirus crisis, the Autorité des Marchés Financiers (AMF)found that in the first five weeks of the crisis, overall trading volumes on Euronext Paris increased three times from the 2019 average. Retail clients of French financial institutions bought shares on an unprecedented scale, with average purchase volumes increasing four-fold.

Increased Measures to Protect Investor Losses

Major brokers cite that they are seeing a lot of intraday trading activities as clients attempt to call the bottom and gain from volatility. But, at the same time the stress on risk management and adjustment of positions to counter volatility is something that was last seen in financial crisis of 2008.

This surge in volatility can also be attributed to the tensions between Russia and Saudi Arabia, leading to an oil price war, monetary tightening policies by the Federal Reserve and the US-China trade war, which led to 2019 ending on a high note. Coronavirus has only boosted the volatility that these events caused.

While demand for trading has increased, brokers need to take extreme precautions to monitor the drop in liquidity. With increasing volatility, the chances of investment losses also rise, which is why brokers are re-adjusting their margins and collateral requirements to protect their clients and firm from such losses.

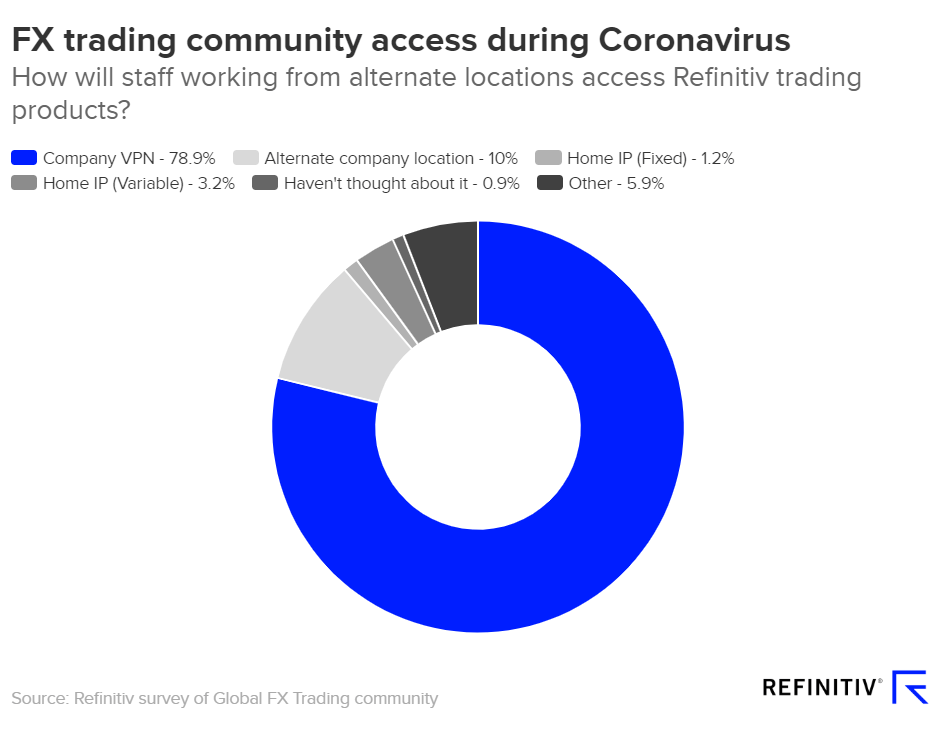

Measures to protect client losses also extend to the technological front. Brokerage firms are ensuring connectivity, compliance and efficiency of execution, catering to the demands of their institutional clients, who want their staff to work from home or from business continuity plan (BCP) locations that are tested. Virtual Private Networks (VPNs) has become a preferred method for ensuring network security.

Image Source: https://www.refinitiv.com/perspectives/future-of-investing-trading/covid-19-a-test-of-fx-trading-continuity/

Diversification to Different Asset Classes

The importance of adjusting trading strategies to accommodate market conditions has never been more important. As traditional asset classes, like the US Dollar, and high-performing tech stocks take a backseat, traders are continuously trying to invest in alternative asset classes. Market conditions that cause one asset class to fall can cause another asset category to do well. Traders are investing now in more than one asset category to ensure an average overall investment return.

Quite naturally, investors have flocked to perceived safety havens like gold and US government bonds.

As of May 11, 2020, the equity markets are seeing a rally, fuelled by huge fiscal stimulus packages announced by various governments worldwide. Commencement of efforts to ease lockdown measures and re-open economies have also been a factor, but the price action of high-yield corporate bonds suggests that bear market conditions are yet to prevail for some time. The pandemic induced demand side shock is too high to be ignored. Gold price is also rallying towards the $1,700 level, as of May 13, 2020, due to persistent presence of market volatility.

Investors are More Interested in Financial Knowledge

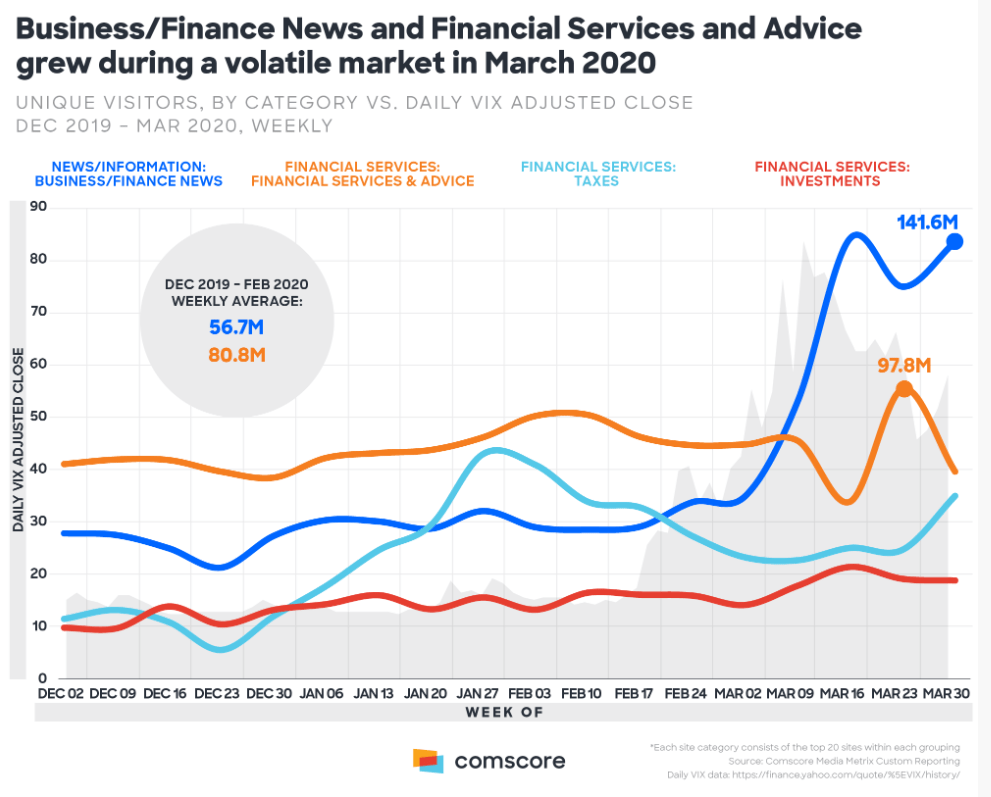

In times of market uncertainty, traders and investors have been seen to search for online sources of information. There has been a considerable uptrend in seeking financial education. For example, in the US, many investment sites like discount and retirement brokerages, tax-related sites have seen an increase in visitors and engagement levels.

Between March 30, 2020, and April 5, 2020, when President Trump announced a national state of emergency, business/financial news platforms recorded 141.6 million unique visitors, which is almost three-times the weekly average in December 2019 of 51.7 million. The average number of visits per visitor across tax and investment sites also increased.

Image Source: https://www.comscore.com/Insights/Blog/Consumers-Seek-Financial-Education-During-Coronavirus-Uncertainty

As financial markets continue to fluctuate in this crisis, financial service providers have to continue being credible sources of information, wherever possible. This is not only important in terms of building customer satisfaction and brand loyalty, but also to maintain market stability. It is known that markets react to news and perceived outcomes. Timely distribution of important information can empower traders to make quick decisions, in a broader context, ensuring balance of trading outcomes. It is also vital to impart education regarding prompt risk management tactics and adjustment of trading strategies to reflect market conditions.

Reference Links

- https://insight.kellogg.northwestern.edu/article/what-explains-the-unprecedented-stock-market-reaction-to-covid-19

- https://www.refinitiv.com/perspectives/future-of-investing-trading/the-covid-19-crisis-brings-volatility-back-to-the-fx-market/

- https://www.amf-france.org/en/news-publications/publications/reports-research-and-analysis/retail-investor-behaviour-during-covid-19-crisis

- https://www.comscore.com/Insights/Blog/Consumers-Seek-Financial-Education-During-Coronavirus-Uncertainty

- https://www.tradersmagazine.com/am/covid-19-a-test-of-fx-trading-continuity/

- https://www.financemagnates.com/analysis-retail-fx/coronavirus-and-forex-how-well-are-brokers-faring/