Three Rising / Falling Valleys

Three rising valleys and three falling peaks may sound like an incomplete haiku to most people, but to traders it sounds more like the ring of a cash-register. What it is in fact is a fairly reliable chart formation that indicates the end of a previous downward trend.

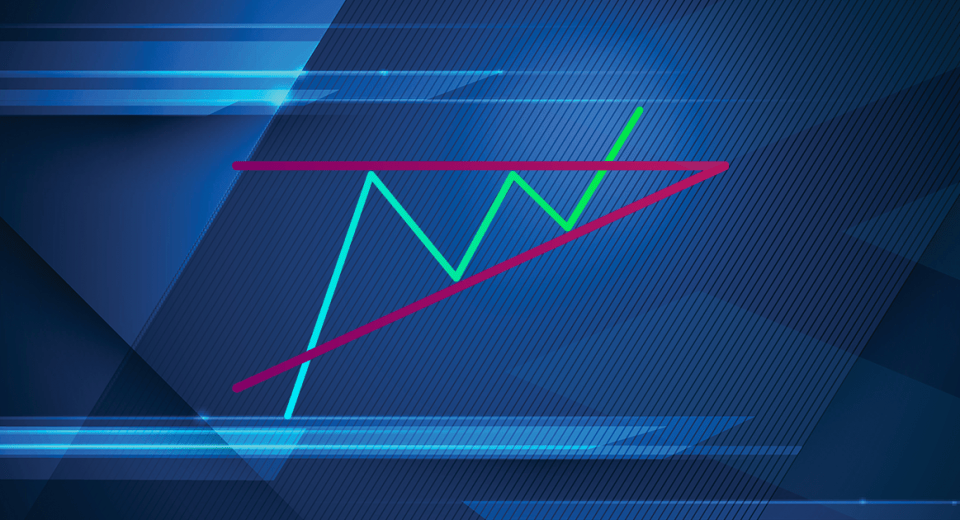

Consisting of three consecutive higher lows or valleys than the previous or following lows, the three valleys are similar in shape and structure. The three rising valleys pattern hints at a potential upward move when the price closes above the highest high established since the first low. So, the respective chart formations of falling peaks and rising valleys always consists of three peaks and two intermediate valleys or three valleys and two intermediate peaks. Entry trades based on these patterns call for buying at the highest intermediate peak, in case of three rising valleys, and selling at the lowest intermediate valley, in case of three falling peaks.

Still with us? Let’s take a more detailed look at how to spot this pattern appearing on your chart and what you need to know about trading it.

Finding the Three Rising Valleys

For identifying the three rising valley trend, we need to select a low point on a chart and then look for two subsequent higher minor lows. The pattern consists of three higher lows that have the same shape and characteristics and are quite narrow. The pattern is confirmed when the price closes above the pattern’s highest high. Experts recommend that a trader take a long position only after the pattern has been confirmed.

Since these patterns are formed across all chart timeframes, one can look at a one timeframe higher than the one selected for the strategy for confirmation. The peaks and troughs creating the three rising valleys are generally visible as a series of rising candlesticks in the one-higher timeframe.

Another important feature of this pattern is that each valley should look similar, so we need to select either all narrow ones or all wide ones.

Identifying the Three Falling Peaks

Now let’s look at the three falling peaks chart pattern, which is characterised by three peaks, each successively below the previous one. When the price closes below the lowest valley between the three peaks, it confirms the reliability of the pattern.

The first sign of a trend change from up to down starts with a lower peak. Now, waiting for the pattern to be confirmed before exiting a position is likely to lead to huge losses, so this pattern is not very useful as a bear market indicator. However, one can use this pattern as an indication that long positions are not recommended in the current scenario.

Factors to Consider While Identifying These Patterns

Now, what happens if one of the series of three valleys is lower than the previous one(s)? This invalidates the pattern. Similarly, if one of the highs in the pattern is lower than the last, then the pattern is invalid. One can say that a three rising valley pattern is confirmed when price closes above the high of the second peak and after the third rising valley. This is also the entry signal.

Although the success rate of this pattern can be quite high, some things need to be kept in mind while placing trades, such as overhead resistance level and other associated risks.

To conclude, even though these patterns are quite frequent and appear across all time frames, traders should wait to pick the pattern with the best characteristics and confirm it with some other trading tools before taking a trade position. Another thing to remember while using these patterns is that the patterns that form under favourable conditions (a bullish market) are bound to yield better results than patterns formed in bearish market conditions. Another word of caution for traders is that in bull market conditions, one might expect large gains from a three rising valley pattern. At the same time, however, one should also be aware of quick reversals. So, it is always advisable to check for evidence of resistance that may limit the trade’s upside potential.

Disclaimer

If you liked this educational article please consult our Risk Disclosure Notice before starting to trade. Trading leveraged products involves a high level of risk. You may lose more than your invested capital.