How to Trade with the Pin Bar Indicator

Pin bar patterns were first discussed by Martin Pring, in his book, Pring on Price Patterns. They were referred to as “Pinocchio Bars” at that time. This was because the original figure looked a bit like Pinocchio’s nose. These patterns are extremely popular, since they offer fairly reliable reversal signals, when used accurately.

Martin Pring also called them Pinocchio Bars because they can lie. They might misdirect you about the direction of the market. These patterns often create a break in price movements. But these breaks are generally false moves, as the price movement recovers to the range of the previous candle after the break.

What Makes a Pin Bar?

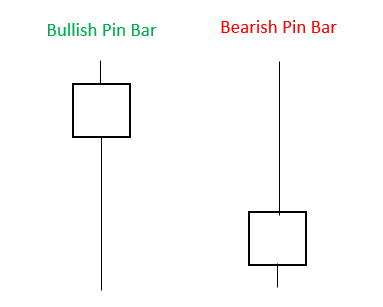

A pin bar consists of a single price bar. This is generally a candlestick bar and represents a sharp rejection or reversal of price. Also known as pin bar reversal, it is represented by a long tail, also known as the “wick” or “shadow” of the candlestick pattern. The region between the open and close of the pin bar is known as the body of the bar. In comparison to the tail, pin bars have very small bodies.

The price that was rejected is shown by the tail of the pin bar. This implies that the price would continue to rise in the direction opposite to which the tail points. So, a pin bar with a long upper tail signals a bearish market, while a bullish pin bar would have a long lower tail. This shows the rejection of lower prices, implying a near-term increase in price.

Trading with Pin Bars

Here’s a look at some of the most popular pin bar trading strategies:

Trend Trading

A pin bar entry signal can offer a great risk to reward ratio and a high probability entry scenario in a trending market. It shows a battle between the bears and bulls, signalling the weakening of the previous trend. So, a bearish trend should exist for a bullish pin bar. Similarly, before the formation of a bearish pin bar, a bullish trend is required. For a pin bar strategy in which there is a reversal of a bullish trend, the following steps can help:

- From the lowest to the highest point, measure the entire length of the pin bar.

- When the price drops below the lowest point, taking a short position may be beneficial.

- At the highest point in the bearish pin bar, a stop loss order may be placed.

- The length of the pin bar minimum is recommended to be projected at least 2 times below the entry point.

At times, the market can reverse so aggressively after the pin bar formation that the trading strategy may offer a risk to reward ratio of greater than 1:2. To ensure that they don’t miss out on identifying the new trend, the stop loss point can be moved to break even by aggressive traders. This ensures a risk to reward ratio of 1:1.

Trading Using Fibonacci Ratios

Fibonacci ratios are helpful in finding great risk to reward ratios. The steps to follow when trading in a bearish market using Fibonacci ratios are:

- From the highest point to the lowest point, measure the length of the pin bar.

- Then, using the Fibonacci Retracement tool, find the 50% and 61.8% levels.

- Limit entry below the 50% level.

- Wait for the reversal of the market to the defined area.

- Stop loss can be placed at the highs. In these cases, you may consider going short.

Wedges and Pin Bars

There are 2 types of wedges, rising and falling. A rising wedge signals a bearish pattern, while a falling wedge indicates a bullish pattern. During the formation of the wedge, the price action can be confusing. In a rising wedge, the market continues to see higher highs and higher lows. In a falling wedge, there are lower highs and lower lows. But the market lacks meaningful conviction.

The nature of these trend lines gives the wedge its shape. The lines converge towards a single point until the wedge breaks. On most occasions, before the wedge breaks, the opposite trendline is pierced. When that happens, traders tend to look for a pin bar. This points towards the reversal of the market. In these cases, the Fibonacci trading strategy discussed above would not work because the rejection is too abrupt and powerful. This means that there would not be any pullback into the Fibonacci area.

Instead, using the classic way for trading pin bars works great here. For instance, in the chart above, there is a bullish trend. There is a series of higher highs and higher lows. However, there is only marginal follow through. When the opposite trendline is pierced by the price, a bearish pin bar is formed. After this, there is a firm rejection, and the wedge is broken by the candle. In such situations, traders prefer to focus on trading the rising wedge. They:

- Take a short position upon breaking of the wedge.

- At the top of the wedge, a stop loss is placed.

- The risk is measured and a minimum of 1:3 risk to reward ratio is projected.

Additional Tips for Pin Bar Trading

- Do not assume that market reversal is certain because of the formation of pin bars. It only points towards the possibility of a reversal.

- Not all pin bars are equal. The best candlesticks for trading have a body that is not more than 20% of the total measurement of the candle, from body to the tip of the wick. The candlestick should also have a small nose. If the nose is too long, it would be classified as a doji. This is a candlestick that has a small body and wicks of equal length on both sides.

- Trading with pin bars on a demo account beforehand can also be helpful.

Pin bars can be an extremely useful tool. But it must be remembered that they are not a magical formula. For best results, they should be combined with other technical analysis tools.

Reference Links

ForexTraders, Priceaction, Colibritrader.